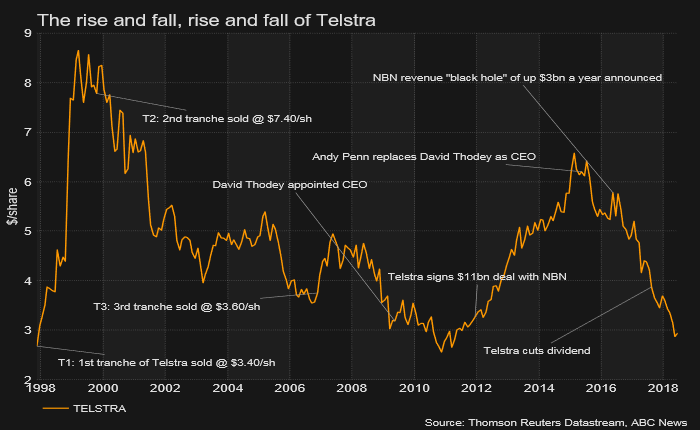

TELSTRA SHARE PRICE - A SAD HISTORY

Source: Telstra Annual Report 2018

Continuing Operations 2018 2017 2016 2015 2014

Total Income $29,042m $28,205m $27,050m $26,112m $26,296m

Profit $ 3,529m $ 3,874m $ 3,832m $ 4,114m $ 4,549m

Dividends per share 22.0c 31.0c 31.0c 30.5c 29.5c

Continuing Operations 1 2018 2017 2016 2015 2014

Total income excluding $29,042m $28,205m $27,050m $26,112m $26,296m

excluding finance income

EBITDA 2 $10,121m $10,679m $10,465m $10,533m $11,135m

EBIT 3 $ 5,651m $ 6,238m $ 6,310m $ 6,559m $ 7,185m

Profit for the period from $ 3,529m $ 3,874m $ 3,832m $ 4,114m $ 4,549m

continuing operations

Profit for the period from $ -m $ -m $ 2,017m $ 191m $ -204m

discontinued operations 4

Profit from continuing and $ 3,529m $ 3,874m $ 5,849m $ 4,305m $ 4,345m

discontinued operations

Dividends declared per 22.0c 31.0c 31.0c 30.5c 29.5c

share (cents)

Total assets $42,870m $42,133m $43,286m $40,445m $39,360m

Gross debt $15,368m $16,218m $16,009m $14,962m $16,048m

Net debt $14,739m $15,280m $12,459m $13,566m $10,521m

Total equity $15,014m $14,560m $15,907m $14,510m $13,960m

Capital expenditure 5 $ 4,717m $ 4,606m $ 4,045m $ 3,589m $ 3,661m

Free cashflow $ 4,695m $ 3,496m $ 5,926m $ 2,619m $ 7,483m

Earnings per share (cents) 30.0c 32.5c 47.4c 34.5c 34.4c

Dividend payout ratio (%)6 73% 95% 65% 88% 86%

Notes:

1.Represented the Autohome Group being classified as a discontinued operation.

2.Operating profit before interest, depreciation and amortisation and income tax expense. EBITDA is used as a measure of financial performance by excluding certain variables that affect operating profits but which may not be directly relate to all financial aspects of the operations of the company. EBITDA is not a measure of operating income, operating performance or liquidity under A-IFRS. Other companies may calculate EBITDA in a different manner to us.

3.EBITDA less depreciation and amortisation.

4.Profit/(loss) for the year from discontinued operations for FY15 and FY16 included both Sensis and Autohome Group results, while FY14 and FY13 only included Sensis results.

5.Capex is defined as additions to property, equipment and intangible assets including capital lease additions, excluding expenditure on spectrum, measured on an accrued basis. Excludes externally funded capex.

6.Dividend payout ratio from continuing and discontinued operations. Dividend payout ratio from continuing operations FY16: 98%

Source: Telstra Annual Report 2018

Total external income FY18 FY17 ChangeTelstra Consumer and Small Business $14,683m $14,722m -0.3% Telstra Enterprise $ 8,249m $ 8,108m 1.7% Telstra Wholesale $ 2,737m $ 2,837m -3.5% Telstra Operations $ 1,217m $ 1,151m 5.7% All Other $ 2,156m $ 1,387 55.4% Total Telstra segments $29,042m $28,205 3.0%

Source: Telstra Annual Report 2018

2016 17.2m 2017 17.4m 2018 17.7m

Source: Telstra Annual Report 2018

| Telecom |